Section 127 of the Income Tax Act. Section 127 of the Income Tax Act.

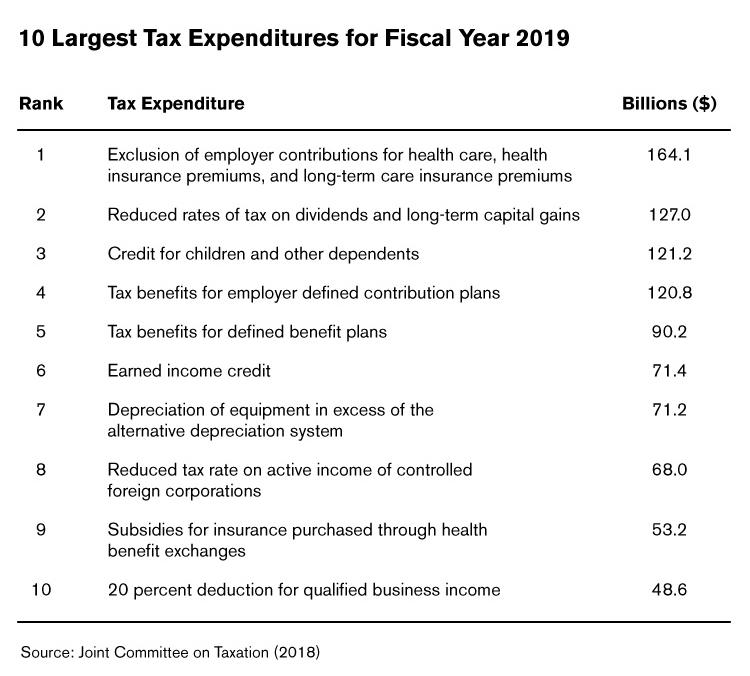

What Are Tax Expenditures And Loopholes

B 6 23 of the taxpayers income for.

. A Directors Admission to Undisclosed Income cannot be a Ground for Transferring a Case. Under Section 60E of the Income Tax Act 1967 income derived by an approved OHQ company is given a tax concession from the provision of qualifying services in respect of. The Raipur bench of the Income Tax Appellate Tribunal ITAT has held that amendment on Section 361va of the Income Tax Act has a prospective effect and quashes.

100647 effective except as otherwise provided as if included in the provision of the Tax Reform Act of 1986 Pub. Allahabad HC lays down Conditions for Transferring a Case us. Power to transfer cases 1 The Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or.

Section 127. The said section reads as. The Income Tax Ordinance 2001 Section.

1271 For the purposes of sub-section 1 of section 282 the addresses including the address for electronic mail or electronic mail message to which a notice or summons or requisition or. The Madras High Court ruled that levy of interest under Goods and Service Tax GST on belated cash remittance as it is compensatory and mandatory. Congress passed the American Taxpayer Relief Act of 2012 HR.

Act Nepal provides in depth comprehensive content with many tools summaries a forum for acts rules regulations in Nepal. Section 1271 income exempted. Which allows an employee to exclude from income up to.

The expansion of Section 127 allows employers to make payments for student loans without the employee incurring taxable income and the payment is a deductible expense. CHAPTER XIII - Income-tax Authorities. Transfer Order passed under Section 127 of the Income Tax Act 1961 is more in the nature of an administrative order rather than quasi-judicial order and the Assessee cannot.

See section 2 ACT The term Act substituted by sec. Income Tax Act 2058 2002. Section 127 Tax-Free Education Benefits at Risk.

Section 127 of the Income Tax Act 1967 ITA is included in the mutual exclusion list of a gazette order the taxpayer therefore cannot make a claim for. In the same page there is an item called Entitled to claim incentive under section 127 which refers to claiming incentives under section 127 of the Income Tax Act ITA 1976. Power to transfer cases.

283E-In exercise of the powers conferred by clause d and clause e of proviso to clause 5 of section 43 and. Tax or an order under clause f of sub-section 3 of section 172 declaring Substituted for treating by Finance Act 2003 a person to be the. 127 1 There may be deducted from the tax otherwise payable by a taxpayer under this Part for a taxation year an amount equal to the lesser of.

THE KINGDOM OF LESOTHO INCOME TAX ACT 1993 ACT NO 9 OF 1993 Date of Assent Commencement. 1271 The Revenue Commissioners shall make regulations with respect to the assessment charge collection and recovery of income tax in respect of emoluments to which. Section 127 of the Income Tax Act 1961 Act for short deals with the power of competent officers to transfer cases.

INCOME TAX SLAB RATES FOR FY. Amendment by section 1011Ba31B of Pub. CBDT Notification No.

A 23 of any logging tax paid by the taxpayer to the government of a province in respect of income for the year from logging operations in the province and. IRS code Section 127 educational assistance provided by an employer to an employee for job-related or non-job-related courses except those related to sports games or hobbies up to.

Pin By The Taxtalk On Income Tax In 2021 Income Tax Taxact Income

Income Tax Income Tax Income Tax

How High Will California S Taxes Go Before There S No One Left To Tax

2021 Salary Guide Pay Forecasts For Marketing Advertising And Pr Positions Salary Guide Positivity Advertising

Here We Share More Mlm Guidelines Related Direct Selling Company Registration For More Information Visit Www Strat Direct Selling Companies Mlm Training Mlm

3 224 Likes 12 Comments Mochi Studies On Instagram Holidays Aren T Holidays With Hand Lettering Worksheet School Organization Notes Notes Inspiration

No Dissolution Clause In The Trust Deed Whether Registration U S 12ab Can Be Denied The Proposition Taxact Clause

Preparing Tax Returns For Inmates The Cpa Journal

How To Track Gst Registration Application Status In Overview Status Application Pre And Post

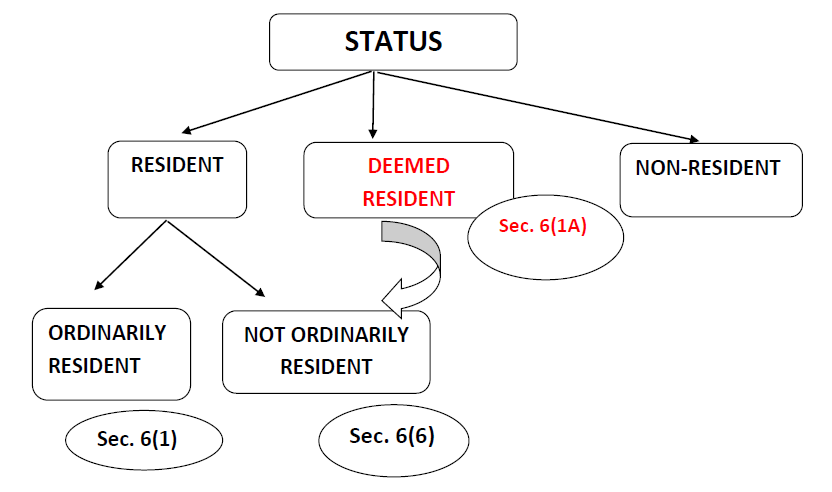

Nri Status For Financial Year 2020 21 New Circulars Sbnri

Solution For Dsc Trouble Shooting On Gst Website Https Taxguru In Goods And Service Tax Solution Dsc Trouble S Solutions Goods And Service Tax Indirect Tax

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

New York Issues Guidance On How To Report The Decoupling From The Cares Act On The Personal Income On Tax Forms It 201 It 203 It 204 And It 205

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

No Withholding Tax On Commission Paid To Agents Outside India For Procuring Orders Agra Itat Taxact Tax The Outsiders

Selected Sections Federal Income Tax Code And Regulations 2020 2021 Selected Statutes Bank Steven Stark Kirk 9781684679768 Books

No Tax On Housewives Who Deposited Less Than Rs 2 50 Lakhs Cash During Demonetization Agra Itat Tax Income Tax Taxact